What is a joint venture? Two or more parties who join together to achieve a common goal.

In this article we will focus on some typical joint venture structures and how they can be used in companies that raise money from private investors. For a more detailed look at the differences between joint ventures and securities, click here to read the article “Joint Ventures or Securities – What’s the Difference?” on our website.

A Closer Look at the Joint VentureStructure; Member-Managed LLCs

A joint venture is typically a general partnership formed between two entities or individuals, with a joint venture agreement that is usually executed by the joint venture participants, describing the rights and duties of each party. The joint venture agreement may allow each entity to operate independently on behalf of the joint venture (as general partners), or it may require the formation of a separate legal entity such as a limited liability company (LLC) where the joint venture partners are its members.

As veteran real estate syndicator Sam Freshman notes in his book, “Principles of Real Estate Syndication,” most syndicated real estate investments these days are organized as Limited Liability Companies (LLCs).

There’s a practical reason for selecting an LLC as the entity for your joint venture: the financial protection of the LLC’s members, whose liability is limited under this structure. There also are tax benefits to using the LLC structure as the income and the taxes pass through to the members (versus paying taxes at the corporate level like corporations do), as well as fewer regulatory hurdles to overcome than with other entity types.

Below we discuss three different applications for member-managed LLCs as joint ventures:

Joint Ventures as Syndicate Managers – where all contribute services

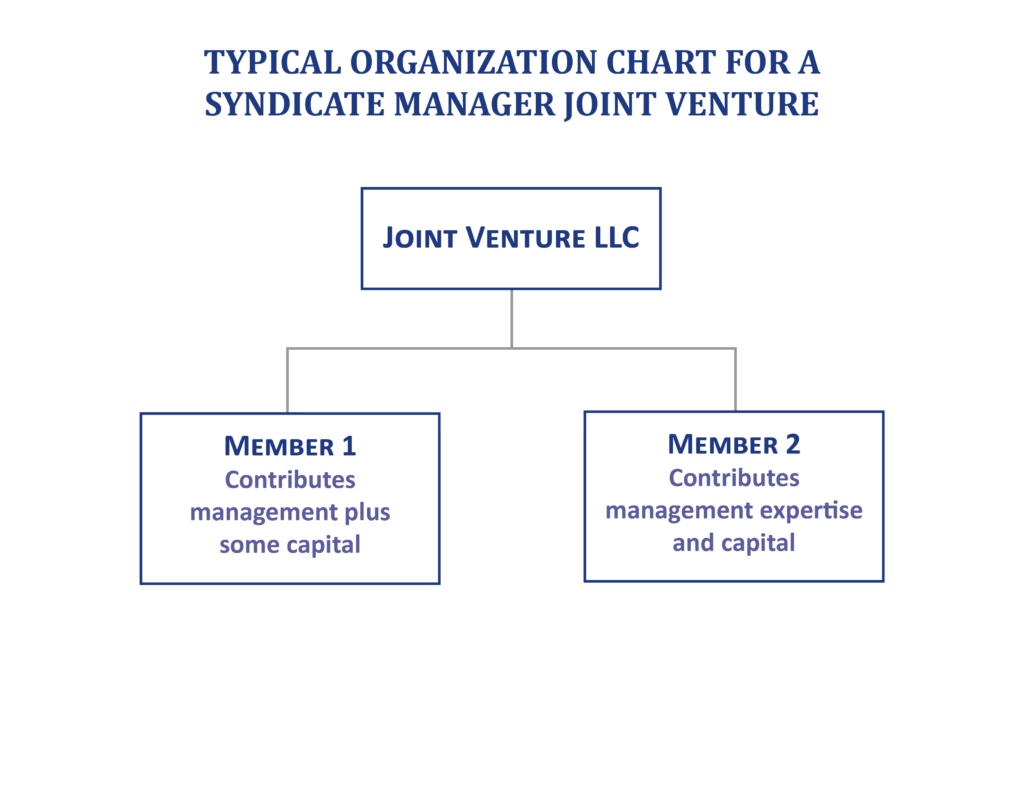

As we have learned in other articles by Syndication Attorneys, PLLC, a syndication typically uses a manager-managed LLC or a limited partnership as its preferred structure. The manager itself is commonly a joint venture. When used this way, multiple individuals who will collectively manage the syndicate form a member-managed LLC to act as the manager or general partner of the syndicate. Its purpose will be to provide liability protection for its members and to perform management functions such as generating the investment opportunity, organizing the company, conducting due diligence or feasibility studies, hiring securities counsel to draft syndication offering documents, and running the company. Below is an organization chart for a typical syndicate manager joint venture:

Joint Ventures for Pooling Investor Funds for Small Deals

A member-managed LLC like the structure shown above can also be used for small joint ventures with 2-3 participants who are each contributing funds and services to accomplish the common goal.

Be careful how you use joint ventures when pooling funds from private investors, however, as each member must be actively involved. They should have a say in how their money is spent, and you should not take control of their money; meaning you will have to get the money from them or at least their permission, every time you need to use it if you don’t want them to be characterized as passive investors – requiring you to comply with securities laws.

This structure can also become unwieldy if you have too many members calling the shots (ever try to get six people to agree on where to go for lunch?), which is why it is not the preferred structure for pooling funds from investors, versus a syndication where the manager calls the shots and investors are passive. But a member-managed LLC is a useful joint venture structure if you are doing very small deals or dealing with very large investors.

A common mistake is to call something a joint venture (usually to try to avoid securities laws) and then advertise for partners when the real objective of the advertiser is to find passive investors. Whenever passive investors are involved, regardless of what you call your company or its members, you will have to follow securities laws, and depending on whom you allow to invest and which exemption you follow, it may be illegal for you to advertise.

Joint Ventures Between Syndicates and Other Investors; Co-Investments for Large Deals

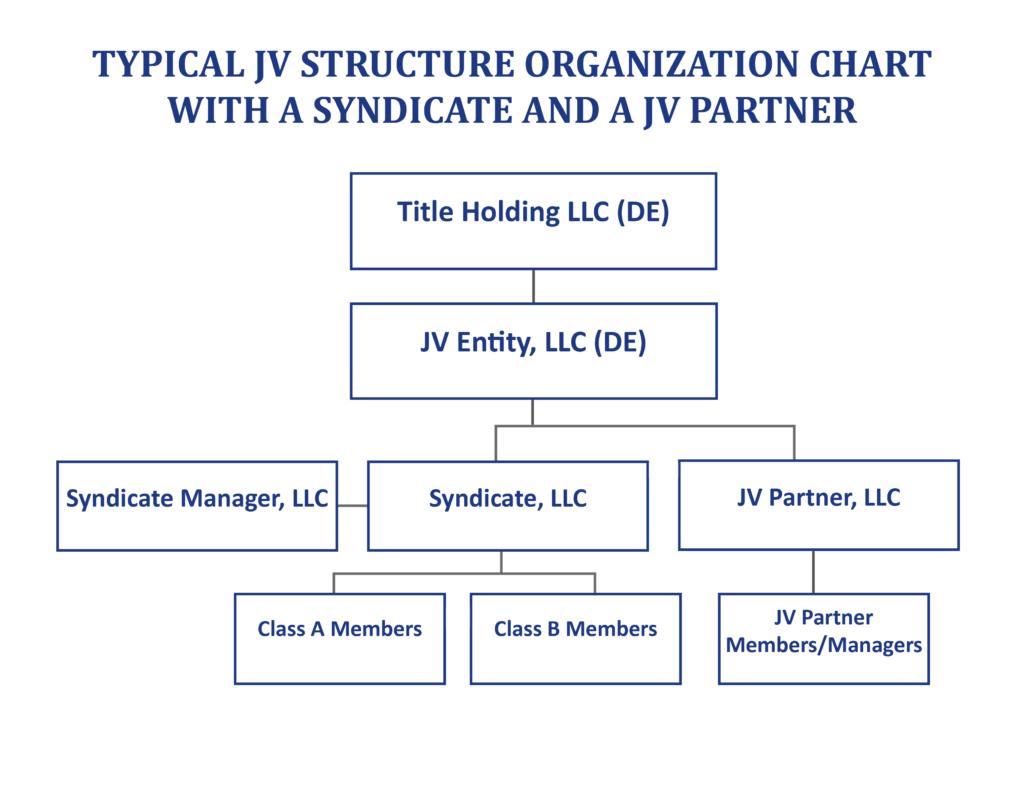

Member managed LLCs can also be used for co-investments where one of the members is a syndicate and the other is an investment bank, private equity fund, family office, or where the entire offering will be funded by a single, large investor. These types of investors typically want to retain some takeover rights, rather than coming in as a passive investor in your syndicate where the syndicator maintains control. Such investors prefer this co-investment structure that allows them to maintain their own rights with respect to the property.

When used this way, your syndicate could be one of the members responsible for raising part of the funds, while the second member will bring in the rest of the funds and may even sign on loan documents, allowing a syndicator to acquire a bigger property than they could do on their own.

Below is an organization chart showing this type of structure:

Conclusion

Conclusion

Syndication Attorneys, PLLC has significant experience helping its clients structure all three types of joint ventures discussed in this article. If you are contemplating engaging in the third type of joint venture structure, please contact us when you are in the beginning stages of negotiating terms, as it always costs more in legal fees to fix a joint venture structure gone wrong than it does to structure it right in the first place. Further, it is a fatal mistake to enter into a joint venture without an agreement, as those are the agreements that often end in lawsuits.

For additional information, please contact our office at 1-844-SYNDIC8 or info@syndicationattorneys.com