In our December 2020 free educational webinar, attorney Kim Lisa Taylor provided details of recent SEC actions and proposals that have positive implications for capital raisers.

Unfortunately, we encountered technical difficulties with the recording of the webinar. However, in lieu of a replay, we offer you this written update from Kim which was the basis of the discussion:

Recent SEC Updates Make it Easier to Raise Capital from Private Investors

In the past several years, private securities offerings have surpassed the funds raised in registered (i.e., public) offerings. Due to the magnitude of private funds being invested outside the public markets, the United States Securities and Exchange Commission (SEC) created the Office of the Advocate for Small Business Formation, whose role thus far has been to facilitate new capital formation, review and update existing rules, eliminate inconsistencies between Securities regulations, and relax standards that appear to be outdated.

While the rest of us were hiding in our houses fearful of COVID-19, binge-watching Netflix and Hulu and trying to keep track of the election twists and turns, the SEC staff has been busy proposing and adopting new regulations, some of which may have a significant positive impact on raising private money.

Here’s what they’ve been up to:

Proposed Finder’s Rule Highlights:

- Allows unlicensed Finders to refer Accredited investors to private securities offerings and receive a commission from the Issuer. The rule is currently proposed and even if approved, is months away from enactment.

Harmonization Amendments to Exempt Offerings Highlights:

- Reg A+, Reg CF and Rule 504 offering limits are increased.

- Integration rules have been clarified for successive offerings.

- Financial reporting requirements for Issuers of Rule 506(b) offerings have been modified.

- The final rule was issued November 2, 2020, but won’t be enacted until 60 days after publication in the Federal Register.

Accredited Investor Amendments Highlights:

- Expands the definition of Accredited investors to include non-married couples and certain securities licensees, with the ability to add further categories of Accredited investors by order.

- Becomes effective December 8, 2020.

Here’s a more-in-depth summary of what’s proposed, what’s been approved, and how it affects you as a syndicator:

Proposed Finder’s Exemption for Private Offerings:

On October 7, 2020, the SEC proposed a new Finders exemption that would allow commissions to be paid to certain unlicensed persons who refer Accredited investors to private securities offerings. This is a proposed rule that creates two “tiers” of Finders who can legally receive commissions for referring investors to a securities offering without having a securities license. The comment period closed for this proposed rule on November 12, 2020.

The SEC created a handy chart that describes the difference between Tier 1 and Tier 2 Finders, which can be accessed by clicking here.

If you wish to read the proposed order, you can do so by clicking here.

The proposed Finder’s exemption would only apply if all of the following conditions are met:

- A Finder would not be subject to regulatory reporting,

- A Finder must be a Natural Person,

- The offering must be exempt from registration under The Securities Act of 1933 (such as Regulation D, Rule 506) — the rule does not apply to referring investors to registered offerings (such as Reg A+ or other registered (public) companies),

- The Finder cannot engage in general solicitation — so no advertising for investors for this purpose is allowed,

- The investor must be accredited, and

- The Finder and Issuer must enter into a written agreement with respect to the services offered and the amount of compensation.

- The Finder cannot be an “associated person” of a securities broker-dealer (so it would not apply to current securities licensees, who must continue to operate within the constraints of their licenses).

The Finder cannot do any of the following things:

- Be a disqualified person or bad actor,[1]

- Engage in resales of securities,

- Be involved in structuring the transaction or negotiating the terms of the offering,

- Handle investor funds or securities, or contractually bind the investor or Issuer,

- Participate in preparation of sales materials,

- Perform independent analysis related to the securities,

- Provide financing for the purchase of the securities,

- Opine regarding the advisability of the investment for a particular investor.

The proposed Finders are further divided into 2 categories:

Tier 1 Finders would be limited to referring investors to a single capital-raising transaction by a single Issuer within a 12-month period and would be prohibited from communicating with prospective investors about the Issuer. Introductions only.

Tier 2 Finders are allowed to:

- Solicit investors on an Issuer’s behalf,

- Identify, screen and contact potential investors,

- Distribute offering materials to prospective investors,

- Discuss information in the offering materials with investors, and

- Coordinate meetings between the Issuer and investors.

However, Tier 2 Finders are required to provide disclosures to investors, prior to or at the time of solicitation, regarding their role and compensation and conflicts of interest; and to obtain the investor’s dated written acknowledgment of having received such disclosures.

This proposed rule has not yet been approved. The public comment period ended November 12, 2020, after which the SEC will evaluate the responses and if all goes well, will issue the final rule – which could be several months away, if it happens at all.

What does this proposed Finders Rule mean for you as a Syndicator?

First, the rule-making process is underway, and until the public comments have been reviewed and assimilated and a new rule is adopted and published in the Federal Register, the new rule is just a pipe dream, and it’s not the first time it’s been proposed — so don’t hold your breath.

This means it’s still a violation of securities laws for an unlicensed “Finder” to receive “transaction-based compensation” (i.e., commissions) for referring investors to a deal, nor can you, as an Issuer of securities, legally pay any such compensation to anyone without a securities broker-dealer license until such time, if ever, that this rule is finalized and enacted.

The old rule stands: Everyone in management of a syndicate or fund should have a role other than raising money and that’s what they get compensated for; and no formula should be used to take into account how much someone has raised when determining their share of earnings.

Only people with the appropriate securities licenses can receive transaction-based compensation (commissions). For the Issuer, paying unlicensed brokers could cause you to lose your exemption at the state or federal level. For a Finder, until this rule gets enacted, acting as an unlicensed broker can get you in heaps of legal trouble and could make you liable for performance of the investment for those whom you refer for the life of the investment. So, until this rule gets hashed out and takes effect (if ever), don’t pay commissions to unlicensed Finders, and don’t act as one.

Harmonization Amendments to Exempt Offerings:

In March 2020, the SEC proposed amendments meant to “harmonize” (i.e., remove inconsistencies) from the rules surrounding exempt offerings. On November 2, 2020, the SEC adopted the following amendments to the existing rules, which will become effective 60 days after publication in the Federal Register.

The gist of the amendments is that:

- Issuers can now switch from one offering exemption to another more easily.

- Regulation A+ limits have been increased for Tier 1 offerings from $15M to $22.5M and for Tier 2 offerings from $50M to $75M in a 12-month period.

- Regulation Crowdfunding offering limits have been increased from $1,070,000 to $5M in a 12-month period; investment limits have been removed for Accredited investors; and non-accredited investors can user the greater of their income or net worth when determining investment limits.

- Rule 504 limits have been increased from $5M to $10M.

- Rules regarding “demo day” communications and “testing the waters” solicitations of interest have been clarified as follows:

-

- Issuers can now use “generic solicitation of interest materials” to test the waters for an exempt offering prior to determining which exemption it will use to sell its securities.

- Regulation Crowdfunding Issuers can “test the waters” to gauge interest prior to filing their Form C with the SEC.

- An Issuer’s participation in certain “demo day” communications in a setting where potential Issuers are invited to meet with potential investors (organized by a college, incubator, angel investor group, etc.) who have gathered to review investment opportunities for the purpose of investment will not be deemed general solicitation or advertising on the part of the Issuer.

-

- Certain disclosure and bad actor disqualification requirements have been made consistent between Regulation D, Regulation A and Regulation Crowdfunding.

- An Accredited investor verification for an investor who previously invested with an Issuer is now good for a period of up to 5 years so long as “the investor provides a written representation that the investor continues to qualify as an Accredited investor and the Issuer is not aware of information to the contrary.”

- Integration rules with respect to successive offerings have been clarified; read more on this below.

The financial information an Issuer must provide to non-accredited investors in a Rule 506(b) private placement must mirror the financial information Issuers must provide to investors of Regulation A+ offerings; read more on this below.

Integration

One of the harmonization efforts was aimed at a concept called “integration,” which occurs when an Issuer makes parallel or successive offerings in close time proximity. In such cases, the SEC may take the position that the two offerings are really part of the same offering for purposes of determining compliance with securities laws. The issue is that if the offerings are integrated, the exemption may no longer be available.

For instance:

- What if an Issuer engaged in a Rule 506(b) offering that included 20 non-accredited/sophisticated investors and then did a second offering with another 20 non-accredited/sophisticated investors? If the two offerings were integrated (i.e., combined), collectively, the single offering would violate securities rules as it had exceeded the limit of 35 non-accredited investors.

- Or alternatively, if one offering was a Rule 506(b) offering followed closely by a Rule 506(c) offering, and the two offerings were integrated, the 506(b) exemption could be disallowed because general solicitation and advertising was used to attract investors in the Rule 506(c) offering; or conversely, the Rule 506(c) exemption could be disallowed because the investors in the Rule 506(b) offering were not all verified Accredited investors.

The final rule offered the following 4 “safe harbors” from integration:

Safe Harbor 1: A Rule 506(b) offering where advertising is prohibited that follows a prior Rule 506(c) offering in which advertising is allowed, will not be integrated as long as:

- There is a gap of 30 days between the time the first offering was completed and the second offering was started, and

- The issuer did not find investors for the subsequent Rule 506(b) offering through advertising or the Issuer can demonstrate that it established a “substantive relationship”[2]with each investor prior to the commencement of the Rule 506(b) offering.

Safe Harbor 2: A Regulation S offering[3] will not be integrated with other offerings. This means you can do a concurrent Regulation S and Rule 506 offering, without having the offerings be integrated.

Safe Harbor 3: A registered offering will not be integrated with a prior offering if the offering is made after:

- A terminated or completed Rule 506(b) offering;

- A terminated or completed Rule 506(c) offering made only to qualified institutional buyers and institutional accredited investors; or

- A Rule 506(c) offering terminated or completed more than 30 calendar days prior to the commencement of the registered offering.

Safe Harbor 4: An offering that allows advertising — such as Rule 506(c) — can immediately follow completion of an offering that doesn’t allow advertising without integration (no 30-day gap required).

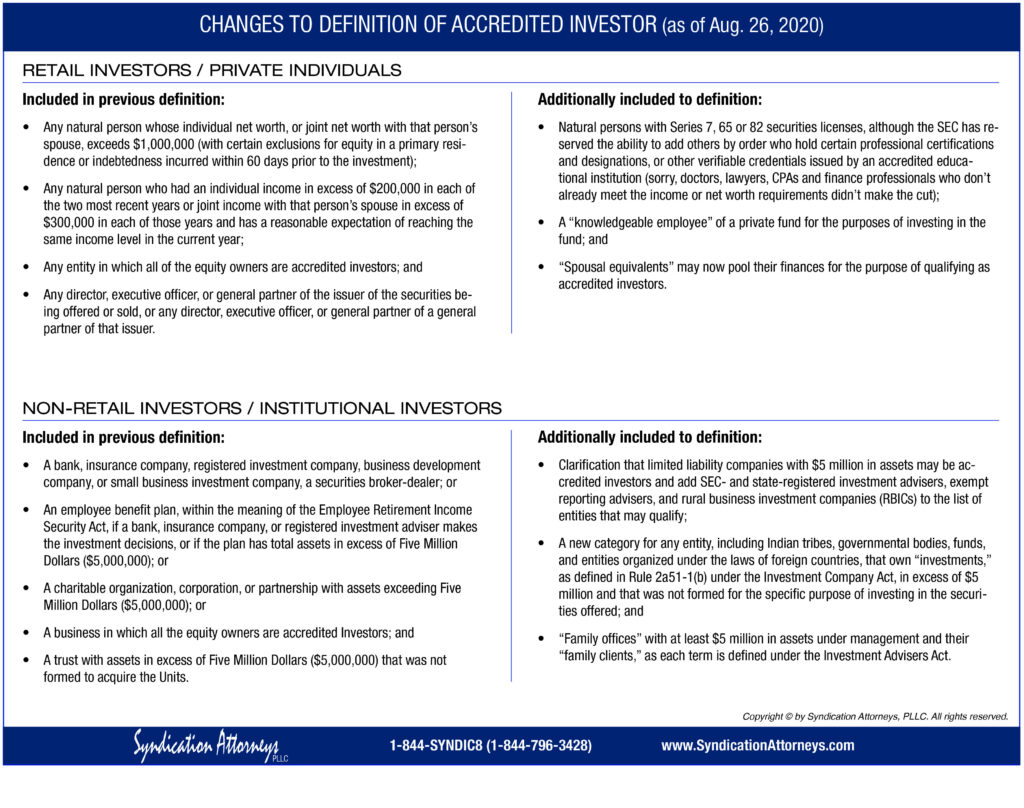

Accredited Investor Amendments

On August 26, 2020, the SEC adopted amendments to the definition of Accredited Investors, to become effective December 8, 2020. A table summarizing the prior and new rules is provided below.

CONCLUSION

So, there you have it. The SEC has been busy working to make capital formation easier for private issuers. What can you do with these new rules to further your syndication business? Call us if you have questions about this or any other securities transaction matter.

[1] As defined in the Securities Exchange Act of 1934, Section 3(a)(39)

[2] In the Final Rule, p. 31, the SEC reiterated its stance on what it believes constitutes a pre-existing substantive relationship necessary for an investor’s participation in a Rule 506(b) Offering (to prove that general solicitation was not used), with relevant excerpts provided below:

“We reiterate the guidance provided in the Proposing Release that we generally view a “pre-existing” relationship as one that the issuer has formed with an offeree prior to the commencement of the offering or, alternatively, that was established through another person… prior to that person’s participation in the offering. A “substantive” relationship is one in which the issuer (or a person acting on its behalf, such as a registered broker-dealer or investment adviser) has sufficient information to evaluate, and does, in fact, evaluate, an offeree’s financial circumstances and sophistication, in determining his or her status as an accredited or sophisticated investor.” The SEC additionally stated: “We do not believe that self-certification alone (by checking a box) without any other knowledge of a person’s financial circumstances or sophistication would be sufficient to form a “substantive” relationship for these purposes.” The SEC further opined: “Investors with whom the issuer has a pre-existing substantive relationship may include the issuer’s existing or prior investors, investors in prior deals of the issuer’s management, or friends or family of the issuer’s control persons.”

[3] This Safe Harbor also applies to an offering made in compliance with Rule 701, pursuant to an employee benefit plan