NOTE: This article is the first of a 2-part series on 1031 Exchanges and Syndicates using the tenant in common ownership structure for acquisition of commercial real estate. This article describes how 1031 Exchangers can participate in a group investment alongside a Syndicate. Part II describes how asset management fees can be allocated among TIC Owners.

Can 1031 Exchangers participate in a group investment with a Syndicate? This situation often comes into question when a Syndicator is raising money to buy a commercial property and is approached by investors with gain from the recent sale of another property that they wish to invest. If the Syndicate is unable to raise sufficient funds on its own and wishes to admit one of these investors, then the Syndicate must carve out a portion of the property that will be owned directly by these investors, who will become tenants in common (TICs) with the Syndicate.

If the deal is structured properly to comply with Internal Revenue Code Section 1031 (“1031 Exchange Rules”), these investors (“Exchangers”) can defer tax on gain from the sale of their property (“Relinquished Property”). If done improperly, the Exchangers will not be able to defer tax on their gain.

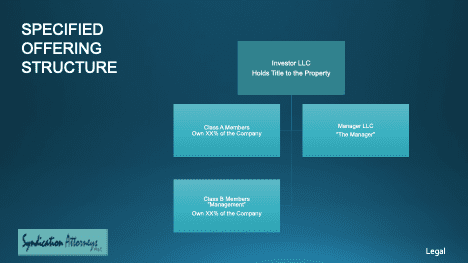

Below is an organization chart showing the typical Syndicate structure for purchase of a specific commercial property (sometimes called a “Specified Offering”):

In the above structure, the Manager would earn fees for its role in managing the asset on behalf of investors (Class A Members). Management would also earn a share of profits (as Class B Members) from cash flow and gain realized on sale of the property. For example, if ownership between Class A and Class B was split 70/30 in a Syndicate, with 70% owned by Class A and 30% owned by Class B, then profit from cash flow or gain from sale would typically be split 70/30 between Class A and Class B, usually after achieving a certain hurdle rate return on investment (i.e., a “Preferred Return”) for Class A. Note, however, there are many possible variations on this scenario (aka “waterfall”). However, in a TIC ownership structure, the profit split described above is disallowed with respect to the ownership portions allocated to the TIC Owners for reasons further explained below.

Syndicates using the Specified Offering Structure shown above are classified as “partnerships” by the United States Internal Revenue Service (IRS) and as such are specifically disqualified from claiming tax-deferral benefits under Internal Revenue Code (IRC) 1031 (“1031 Exchange”). The IRS has published a guidance document regarding 1031 exchanges (entitled “Revenue Procedure 2002-22” ) that describes multiple conditions a group investment must follow to avoid being classified as a partnership.

Note: Syndicates typically sell interests in a company that owns 100% of a property. Such interests are legally are considered “personal property” and are classified by the IRS as “partnership interests,” which are ineligible for 1031 exchange.

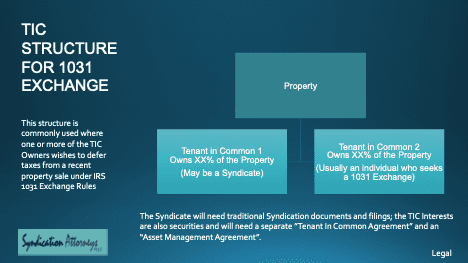

Below is an organization chart showing the typical TIC ownership structure:

In order for a TIC ownership structure to meet the requirements of 1031 Exchange Rules and Rev Proc 2002-22, and not be classified as a partnership, several additional conditions must be met (other conditions apply, but the most provisions most relevant to Syndicators are provided here):

- Direct Ownership of Real Estate: To accommodate this requirement, a tenant in common (TIC) ownership structure is typically used, which allows each investor to acquire fractional interests in a property, usually indicated on the property deed. In a TIC ownership structure, each investor must take direct ownership of the real estate in the “Replacement Property,” the value of which must be greater than or equal to the property sold (“Relinquished Property”). There may be no more than 35 TIC owners.

- Debt Obligation. As direct owners, each TIC owner must be underwritten and guarantee their proportionate share of debt placed on the Replacement Property, the amount of which must equal to or greater than the debt on their Relinquished Property. Note, however, that if debt taken on by an Exchanger is less than the debt on its Relinquished Property, the difference could be offset by its contribution of additional cash.

- Cash Reinvestment. Each TIC owner must invest an amount of cash equal to or greater than the amount of cash they received (“equity”) from the sale of their prior property. This becomes important when discussing acquisition fees.

- The Exchanger Cannot Take Possession of the Equity. A 1031 Accommodator must take possession of the gain from the Relinquished Property until a Replacement Property is identified and purchased and the gain from the Relinquished Property is re-invested.

- Deadlines. Additionally, there are specific deadlines in the 1031 Exchange Rules that must be met both for identification and purchase of the Replacement Property.

- Unanimous Consent. Major decisions, such as refinance or sale of the property, require unanimous consent of all TIC owners. In the event unanimous consent isn’t achieved, the TIC owners typically agree in advance to reciprocal buyout provisions that would allow the consenting TIC owners to buy out the dissenting TIC owner, or vice versa. These rights are described in a TIC Agreement that each TIC owner must sign.

- No Profit Share from TIC Interests. Profits must be split at the property level, in proportion to each TIC owner’s percentage ownership of the property. This precludes an Asset Manager from earning a share of profits from the TIC owners’ share. Note, however, if one of the TIC owners is a Syndicate, the Asset Manager can earn a share of profits from the portion of the property owned by the Syndicate; it just can’t participate in the profits generated by TIC owners other than the Syndicate. This is important, as this is what a Syndicator loses when admitting TIC Owners to its investment. The Syndicator is basically giving away its share of profits from the portion of the property sold to the TIC owners. Thus, the only reason to admit TIC owners is because the Syndicate can’t raise sufficient money on its own to buy the property without TIC owners, or the 1031 funds are the Syndicator’s own funds from a Relinquished Property.

- TIC Ownership Interests are Securities. The TIC ownership interests offered by the Asset Manager are securities and are thus subject to the same securities exemption requirements that are offered to investors in a Syndicate, such as financial qualification requirements of TIC owners, proper disclosure of all material facts and securities notice filings. Simply stated, TIC Oowners should review the same offering materials provided to Syndicate investors and complete a Subscription Agreement for their TIC interests.