The expanded definition of an Accredited Investor[1] finalized by the Securities & Exchange Commission on Aug. 26, 2020, may sound encouraging, but will it really be all that helpful for Syndicators raising money from private individuals (otherwise known as “Retail Investors”)[2] ?

It is not likely. Let’s take a closer look at the SEC’s actions and what it all means.

According to Investopedia, “the retail investment market in the United States is huge. Over 50 million households are retail investors of some kind, and over 50% of households have savings accounts or investment plans like 401(k)s.”

If you’re a Syndicator, this is a target market for investors in your investment opportunities. While some Syndicators gravitate toward institutional investors and the additional costs and complications that presents, others find gold in the millions of Retail Investors they can reach out to on social media and general networking events. So there was hope the new rule and definition would broaden that pipeline even further.

The SEC first issued proposed amendments to the definition of an Accredited Investor[3] on Dec. 18, 2019. The Final Rule was issued on Aug. 26, 2020, and it becomes effective 60 days after publication in the Federal Register.

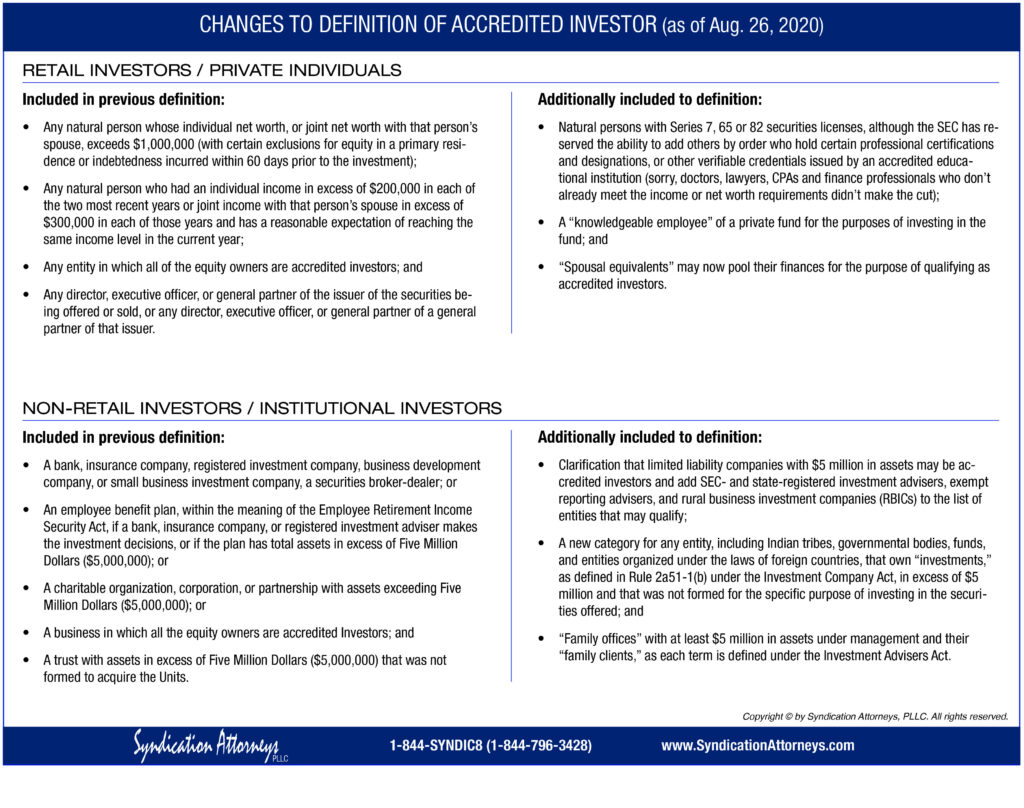

The accompanying chart provides a synopsis of the previous and expanded rules for both Retail Investors and Non-Retail Investors.

So why does this not seem to be much help to your money-raising efforts?

While the SEC can be applauded for actually passing a new rule in the age of COVID, it seems that the new rule isn’t the panacea it could have been with respect to Retail Investors. More work is needed to further expand the definition to include other qualified professionals before it becomes more than marginally useful for Syndicators raising money from Retail Investors.

- The SEC’s press release summarizing the rule can be found here: https://www.sec.gov/news/press-release/2020-191

- The 166-page Final Rule can be found here: https://www.sec.gov/rules/final/2020/33-10824.pdf

[1] See the previous Article in SyndicationAttorneys.com Library entitled “Accredited Investor Definition May Be Changing”

[2] Retail Investors include non-professional individual investors who purchase securities for their own account. According to Investopedia’s definition of a Retail Investor, “the retail investment market in the United States is huge. Over 50 million households are retail investors of some kind and over 50% of households have savings accounts or investment plans like 401(k)s.”

[3] See 17 CFR 230.501(a) aka Regulation D, Rule 501(a)