Kim Lisa Taylor, Esq., is the founder of Syndication Attorneys PLLC, a boutique corporate securities law firm that helps clients nationwide with their federal real estate securities offerings.

Kim Lisa Taylor, Esq., is the founder of Syndication Attorneys PLLC, a boutique corporate securities law firm that helps clients nationwide with their federal real estate securities offerings.

Kim and the other members of the Syndication Attorneys team focus on helping small business owners/developers structure and convey their investment opportunities in a way that will attract private investors, both domestic and foreign. They teach their clients how to use securities laws effectively and provide them the tools and resources they need to achieve their business goals legally. More than a law firm, Syndication Attorneys PLLC helps entrepreneurs create successful investment companies.

Licensed as an attorney in California since 2002, Kim has made corporate securities law her primary focus since 2008. She has been licensed as an attorney in Florida since 2012. Kim has been the responsible attorney for more than 300 Securities Offerings and numerous Joint Venture Agreements for entrepreneurs raising money — $50,000 to $100,000 or more at a time — from private investors, whether from within their own network of family and friends, through crowdfunding on the Internet or from private equity joint venture partners. This has enabled her clients to raise more than $1 billion as of July 2019.

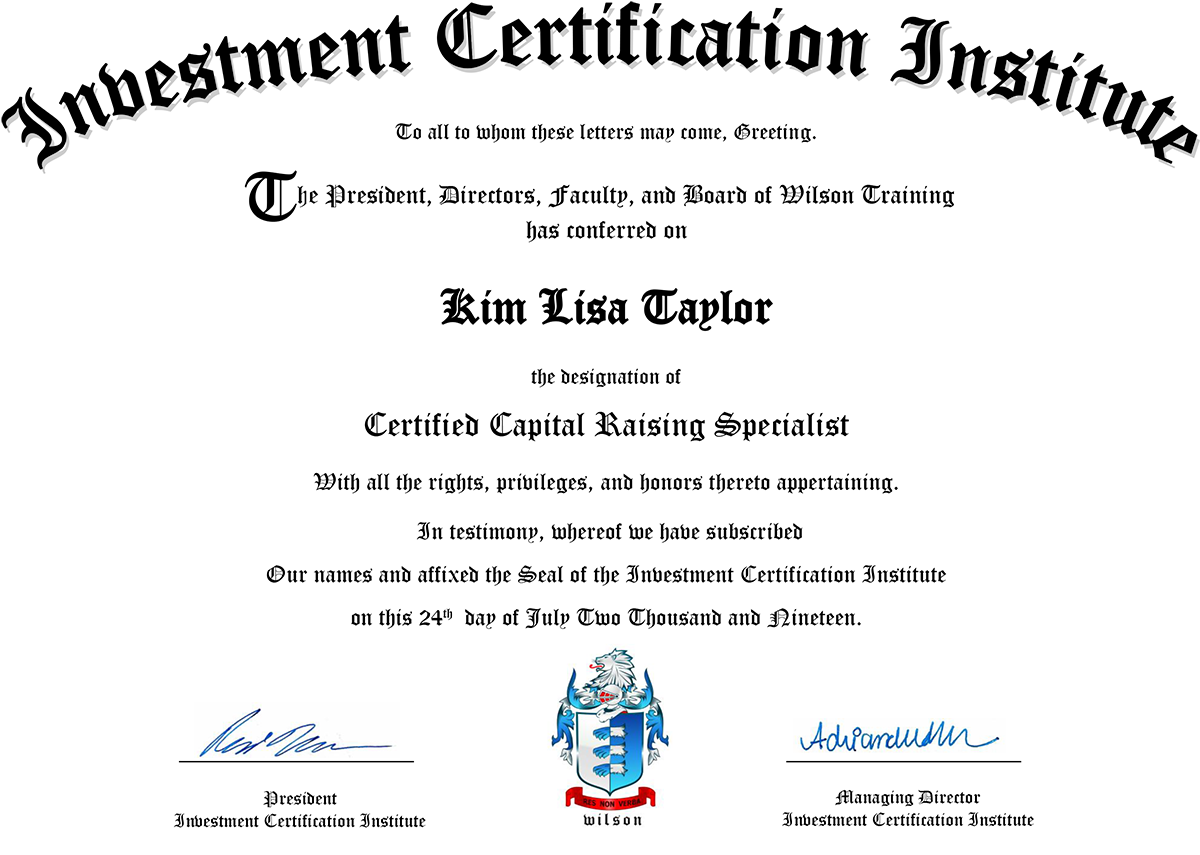

In addition to her work with the firm’s clients, Kim is a nationally recognized expert in the securities industry and a highly sought-after speaker, instructor and author. She also holds the Certified Capital Raising Specialist designation from the Investment Certification Institute.

She has written numerous articles on the subjects of syndication, corporate securities and raising funds from private investors. Many of her articles have been published in nationally distributed magazines and trade journals.

Kim regularly presents educational programs and conducts training at entrepreneur, real estate investing and crowdfunding conferences to help investors understand the complexities involved in raising private money and to keep them on the right side of the law. She has taught groups of all sizes and experience levels how to structure offerings with private investors and how to legally advertise (crowdfund) their offerings.

Among some of her presentation topics and areas of expertise:

- Structuring group investments for multifamily and commercial real estate transactions

- Structuring group investments for hard money lenders

- Using other people’s money and self-directed IRAs to fund real estate transactions

- Legally raising money from private investors

- Blind pools and other types of syndicates

- The JOBS Act, crowdfunding and advertising for investors

- Writing effective investment summaries for investors

- Different means of taking title to investment real estate

- Selecting the proper securities exemption

- Setting up a hard money loan fund

- Including foreign investors in a U.S. securities offering