The statistics in the recently released NASAA (North American Securities Administrators Association) 2022 Enforcement Report only serve to reinforce the need for syndicators and fund managers to be meticulous in adhering to SEC and state rules regarding securities.

When syndicators and fund managers fail to follow securities regulations, including choosing the correct exemption if available, they open themselves up to a variety of penalties and sanctions that can run into tens of thousands of dollars or even jail time.

Regulators reported launching investigations against 1,156 registered parties, including 678 broker-dealer firms and agents, and 478 investment advisers and representatives. In addition, they revoked licenses from 50 securities professionals and barred 61 individuals from the industry.

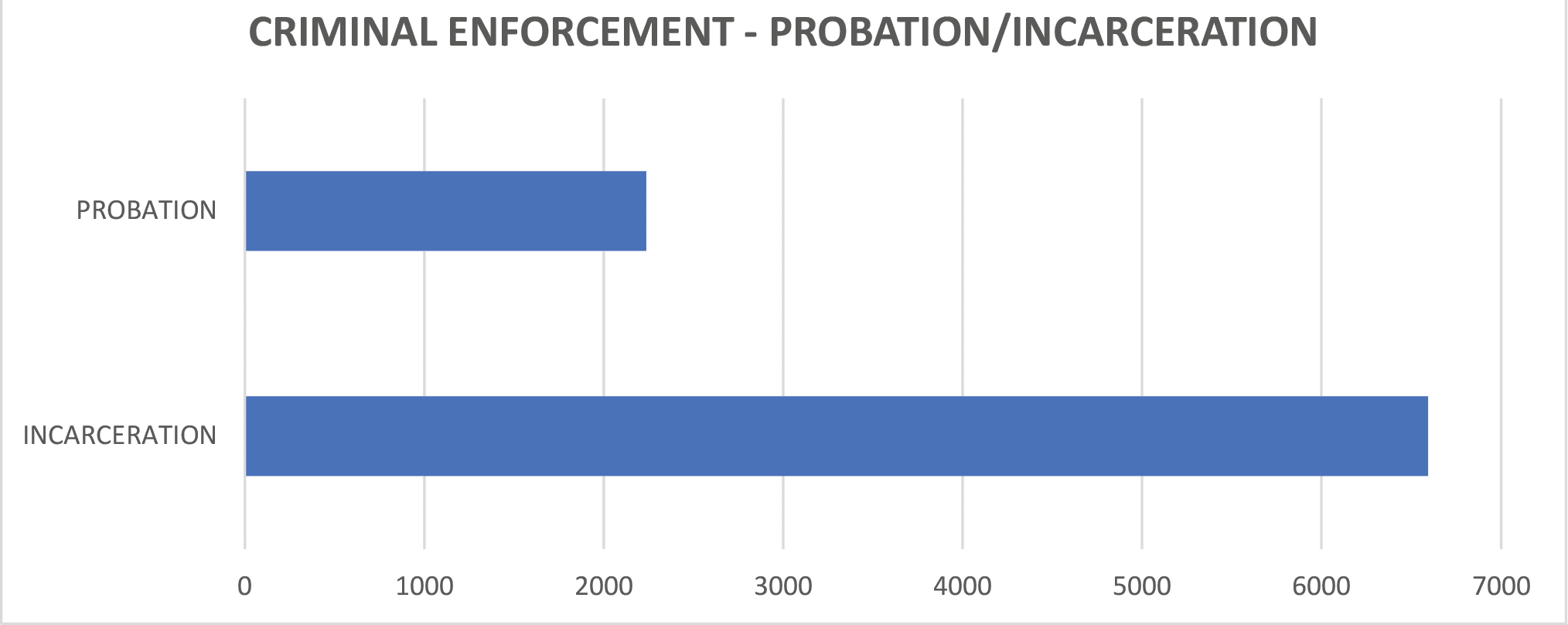

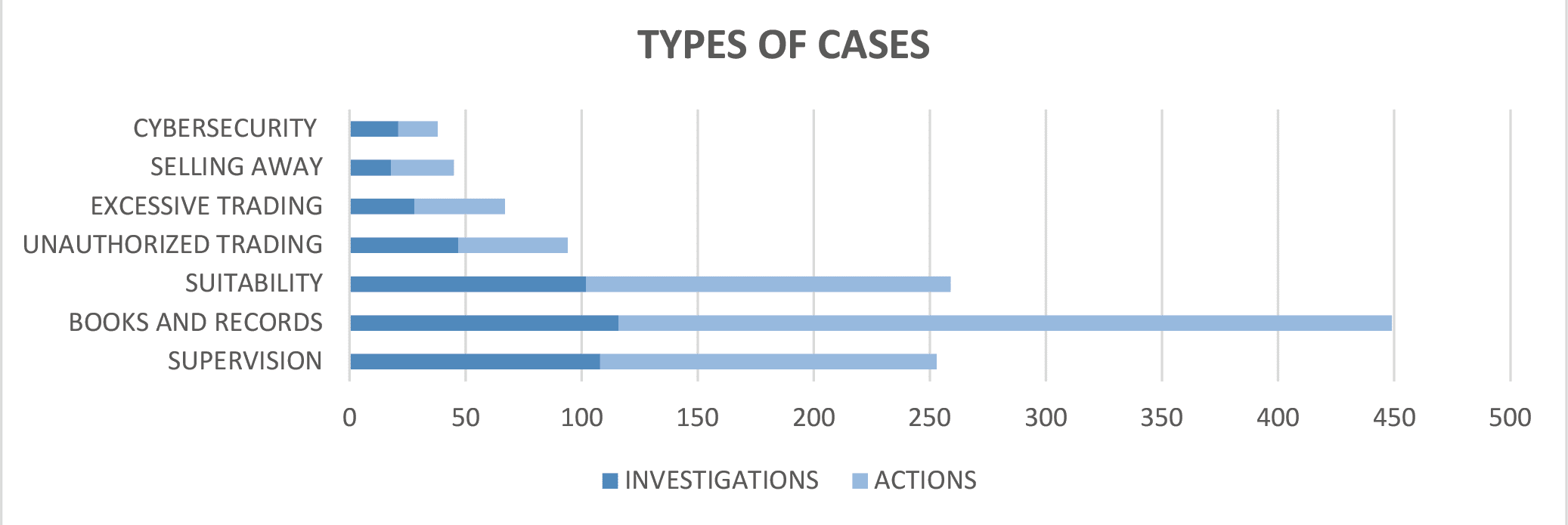

Based on analysis of 2021 data, including responses from 48 of the association’s U.S. member jurisdictions, NASAA reported there were 7,029 investigations conducted, with 1,661 resulting enforcement actions (including 196 criminal actions, 80 civil actions and 1,284 administrative actions). Those in turn led to $312 million in restitution ordered to be returned to investors, as well as $145 million in fines levied and 735 years of incarceration and community supervision.

“These cases involved a variety of tactics and products, ranging from traditional sales of unregistered securities to an increasing number of illegal promotions tied to precious metals, frauds perpetrated through social media and the internet, romance scams and other schemes designed to exploit older investors,” the report noted.

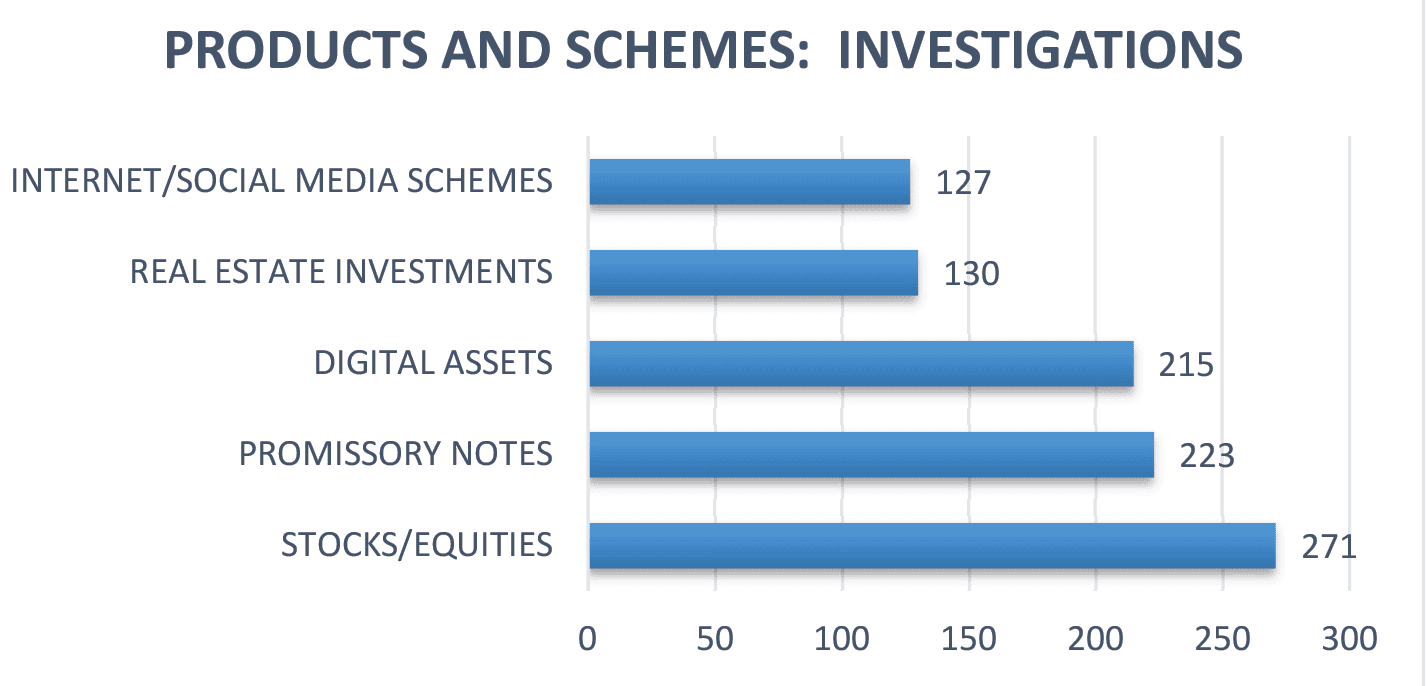

State regulators reported more cases involving promissory notes than any other instrument, which also included Ponzi/pyramid schemes, stocks/equities, digital assets, and internet/social media.

Key statistics from the report include:

- Tips & Complaints: 6,634

- Enforcement Actions: 1,661

- Restitution: $312,097,734

- Fines & Penalties: $145,567,334

- Total Investigations: 7,029

- Licensing Sanctions: 6,014

- Prison/Probation Time: 8,831 months

Click here to get the full report.