Many entrepreneurs and investors who come to the United States on work visas want to start real estate investment businesses and raise capital.

Securities Laws for Raising Capital on a Work Visa

U.S. securities laws are designed to protect investors. They do not restrict who can form a company or sponsor an offering based on immigration status.

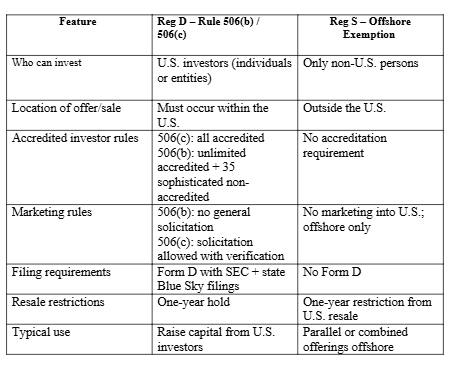

- Regulation D, Rule 506(b) and Rule 506(c) are the most widely used exemptions for private capital raising

- Rule 506(b) allows unlimited accredited investors and up to 35 sophisticated non-accredited investors (but no general advertising)

- Rule 506(c) allows general solicitation and advertising, but all investors must be accredited and verified

- Regulation S allows you to raise funds from non-U.S. persons entirely outside the United States, often in combination with Reg D

- Foreign nationals may form a U.S. entity (LLC or LP) to raise capital under these exemptions

Reg D vs. Reg S – Key Differences

Immigration Restrictions for Visa Holders Raising Capital

While securities laws are permissive, immigration law is often the limiting factor.

- Most work visas (H-1B, L-1, O-1, etc.) restrict employment to a sponsoring employer

- Actively raising capital, managing investors, or running your own real estate investment company may be considered unauthorized employment

- Visa holders may be able to own a U.S. business passively, but not manage it directly

- Immigration violations can jeopardize both your visa and long-term residency goals

Structuring Options for Foreign Nationals

Foreign nationals often resolve these challenges by structuring their roles strategically:

- Form a U.S. entity (LLC or LP) as the issuer of securities

- Appoint a U.S. citizen, green card holder, or otherwise work-authorized partner to manage capital raising and investor relations

- Participate as a passive owner until immigration status changes

- Consider investor-focused visas such as the E-2 Treaty Investor visa or EB-5 Immigrant Investor visa for long-term flexibility

- Use Reg D for U.S. investors and Reg S for offshore investors to broaden your investor base

Key Questions for Your Immigration Attorney

- Can I legally own a U.S. real estate investment company under my visa?

- Does my visa allow me to actively manage or only passively invest?

- Would raising capital from U.S. investors be considered unauthorized work?

- Can I appoint a U.S.-based partner to handle investor relations while I remain an owner?

- Would an E-2 or EB-5 visa better support my long-term real estate investment goals?

- Do I face travel restrictions when meeting offshore investors under Reg S?

Schedule a call with us today: Click Here

Conclusion: Securities Law vs. Immigration Law

From a securities law perspective, it is possible for a foreign national to raise capital under Rule 506 and Regulation S. These exemptions are commonly combined in real estate offerings. The real challenge is immigration compliance. Whether you can actively raise capital depends entirely on your visa category and work authorization.

Before moving forward with a real estate syndication or private offering, consult both a securities attorney and an immigration attorney to ensure your plan is fully compliant.

Disclaimer: This article is for informational purposes only. It is not legal advice, and no attorney-client relationship is created by reading it. Securities laws and immigration laws are complex, and how they apply depends on the specific facts of each situation. We provide securities law counsel only and do not provide immigration advice. Anyone considering raising capital while on a U.S. visa should consult an experienced securities attorney and an immigration attorney. Reliable legal advice can only be given after a full review of the facts and execution of a written engagement agreement.