Launching a Blind Pool Fund sounds like the dream shortcut to growth for new real estate capital raisers. Instead of syndicating deal by deal, these funds allow you to raise money upfront and deploy it across multiple future opportunities as they arise. On paper, the flexibility and scale look appealing—yet in reality, most first-time fund managers without a proven track record face steep investor reluctance and disappointing results.

Understanding Blind Pool Funds

A Blind Pool Fund is an investment vehicle in which investors contribute capital without knowing the specific assets that will be acquired. Instead of presenting a detailed, property-by-property pitch, the sponsor asks investors to trust in their expertise and strategy to find quality deals after the fund has closed. While this structure allows opportunistic investing and competitive dealmaking, it also requires extraordinary investor confidence.

Why First-Time Blind Pools Miss Their Targets

Many new fund managers underestimate a simple but critical hurdle: Investors are wary of promises without proof—especially from managers with no prior syndication or fund management track record.

Core Challenges for New Managers

- Investors must trust the manager’s judgment without seeing or vetting the specific assets.

- Capital often comes slowly unless there is a history of successful syndications or deep trust in the team.

- Even friends and colleagues may hesitate when asked to support an open-ended “investment in a promise,” as opposed to a specific deal they can underwrite themselves.

Eye-Opening Fundraising Statistics

Industry experience and data confirm that the majority of first-time Blind Pool Funds significantly underperform their targets. It’s not uncommon for new managers aiming to raise $10 million to secure only $1–$3 million—often not enough to successfully implement their strategies. Many abandon the fund before their first closing and revert to single-asset syndications.

The Blueprint for Success: How Some New Managers Beat the Odds

Despite the grim stats, some emerging fund managers defy them by carefully structuring their approach.

- They launch with a realistic fund size—often under $5 million, not $25+ million.

- They partner with experienced operators or “co-GPs” who bring an actual, verifiable track record, increasing credibility in investors’ eyes.

- Their investor base is not “cold” or simply acquaintances—it’s been nurtured for years, often through consistent education, thought leadership, and engagement.

- Their investment thesis is narrow and crystal clear (“class B Texas multifamily rehabs”) rather than vague or aspirational (“we’ll buy good deals anywhere”).

A Smarter Path for New Sponsors

- Starting with single-asset syndications to build practical experience and deliver results to investors.

- Using co-GP structures to gain “track record by association” without exposure to unmanageable risk.

- Scaling into a fund structure only after consistently proving their investment and operational capabilities.

What Makes the Difference? The Legal Structure and Honest Assessment

At Syndication Attorneys, our team has guided hundreds of clients through these very challenges. We don’t just draft legal documents—we help new managers make honest, sometimes tough decisions about timing, structure, and investor readiness. Sometimes, the best legal advice is: “Wait. Build your track record first.” Other times, a well-designed Blind Pool Fund can be the right fit—so long as it’s structured for compliance and investor trust from day one.

Is Your Blind Pool Fund Really Viable? Get a Professional Assessment

Thinking about starting a Blind Pool Fund? Don’t guess—know for sure. Our Fund Readiness Assessment gives you clear, actionable feedback in less than an hour. You’ll walk away knowing whether your fund is a go—or if it’s wiser to build your investor base with single-asset deals first.

Ready to find out if your Blind Pool Fund is viable?

Schedule a call with us today: Click Here

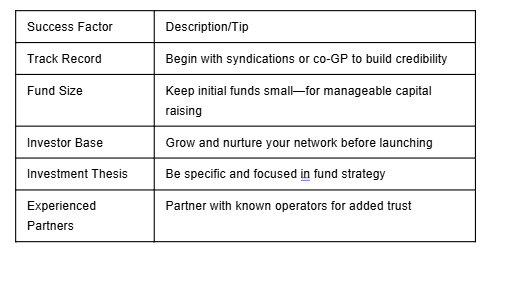

Quick Reference Table: Blind Pool Fund Best Practices